Condo Insurance in and around Medina

Townhome owners of Medina, State Farm has you covered.

Condo insurance that helps you check all the boxes

Your Belongings Need Coverage—and So Does Your Townhome.

As with anything in life, it is a good idea to expect the unexpected and attempt to prepare accordingly. When owning a condo, the unexpected could look like damage to your condo and its contents from fire smoke, wind, and other causes. It's good to be aware of these possibilities, but you don't have to fret over them with State Farm's great coverage.

Townhome owners of Medina, State Farm has you covered.

Condo insurance that helps you check all the boxes

Why Condo Owners In Medina Choose State Farm

You can relax with State Farm's Condo Unitowners Insurance knowing you are prepared for the unanticipated with excellent coverage that's right for you. State Farm agent Mark Lewis can help you explore all the options, from bundling, possible discounts to a Personal Price Plan®.

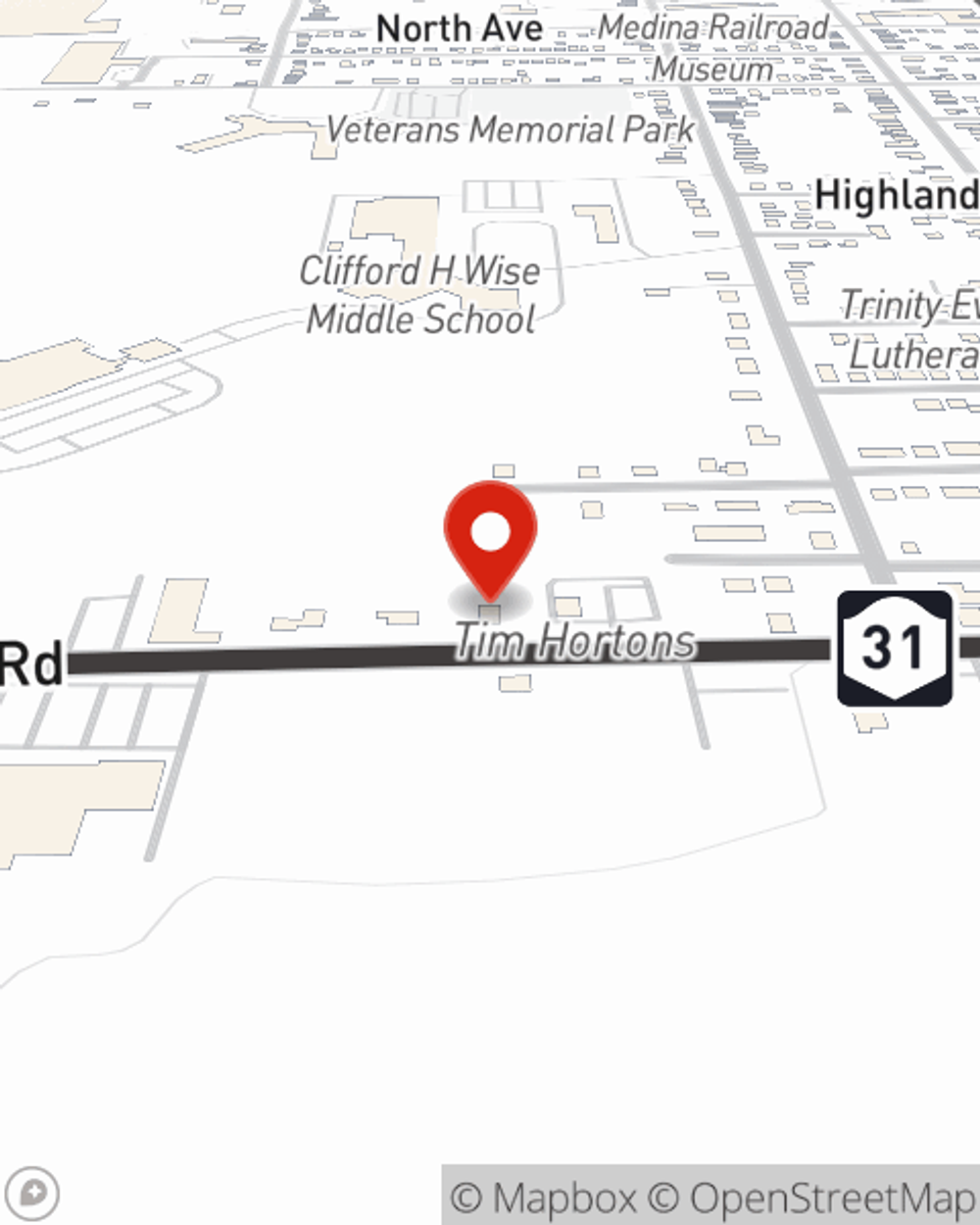

Reach out to State Farm Agent Mark Lewis today to learn more about how one of the top providers of condo unitowners insurance can help protect your townhome here in Medina, NY.

Have More Questions About Condo Unitowners Insurance?

Call Mark at (585) 798-3565 or visit our FAQ page.

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.